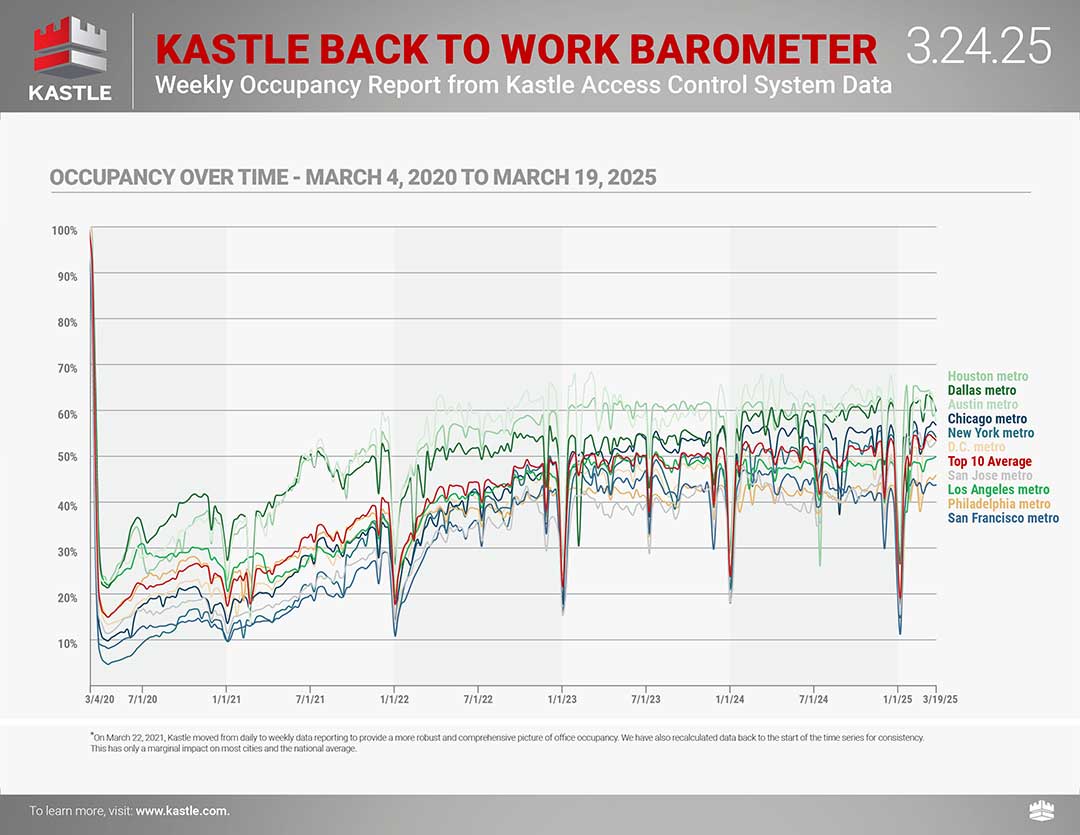

Hybrid work patterns reveal occupancy varies throughout the week with Tuesdays typically being the highest day of the week and Fridays being the lowest. The chart below tracks Tuesday occupancy over time in ten cities and provides a new dimension to the weekly Barometer report. The Peak Day Hybrid Index will now be published weekly, offering a wider aperture into the full picture of workplace occupancy.

Get Weekly UpdatesYou can now track the Return to Work Barometer on the Bloomberg Terminal, available under {ALLX KASL<GO>}

Conferences in Texas Impact Office Occupancy

Peak day office occupancy was 63.1% on Tuesday last week, up two tenths of a point from the previous week. In Austin, the South by Southwest conference and festival led to lower daily occupancy nearly every day. And in Houston, CERAWeek 2025 resulted in significantly lower occupancy last Thursday and Friday before rebounding after the conference, peaking at 71.2% on Tuesday. The 10-city average low was on Friday at 34.3%, down 2.1 points from last week.

The weekly average occupancy fell six tenths of a point to 53.3%, according to the 10-city Back to Work Barometer. Austin had the largest decline, falling 5.7 points to 57.2% as the South by Southwest conference and festival effected traffic and business operations. Most other tracked cities experienced relatively small increases or decreases.

Last week, average occupancy among the Barometer’s Class A+ buildings was 73.9% and Class A+ peak day occupancy reached 91.7% last Tuesday. We will continue to provide insights from this subset of over 100 buildings within the Barometer dataset, which have been categorized as Class A+.

Methodology

To provide some clarity on the issues facing American businesses, Kastle has been studying keycard, fob and KastlePresence app access data from the 2,600 buildings and 41,000 businesses we secure across 47 states. We’re analyzing the anonymized data to identify trends in how Americans are returning to the office.

We have tracked and published U.S. office occupancy status in Kastle-secured commercial properties since the beginning of the Covid crisis in early 2020. We continue to seek to help companies navigate the ever-changing workplace landscape and adjust to the ‘new normal’ of office occupancy. Whether full-time hybrid or in-person, our commitment remains to helping American businesses understand how average workplaces are being attended weekly, monthly, and annually.

Kastle’s reach of buildings, businesses and cardholders secured generates millions of access events daily as users enter office complexes, and individual company workspaces. The Barometer weekly report summarizes access control data among our business partners in ten major metro areas, not a national statistical sample. Charted percentages reflect unique authorized user entries in each market relative to a pre-COVID baseline, averaged weekly.*

*On March 22, 2021, Kastle moved from daily to weekly data reporting to provide a more robust and comprehensive picture of office occupancy. We have also recalculated data back to the start of the time series for consistency. This has only a marginal impact on most cities and the national average.

Click here for more information about the Barometer methodology and FAQ

Ready to make your property smarter and more secure? Connect with Kastle's experts to find the perfect solution tailored to your needs.